- Latest funding round propels Rapido’s valuation to over $1.1 billion

- Investment to accelerate expansion and strengthen Rapido’s leadership in urban mobility

- Investment follows strong user growth, with GMV soaring 2.5 times over the past year, now reaching 2.5 million daily rides.

Rapido, India’s largest ride-sharing platform, has received commitments to the tune of ~$200 million in its Series E funding, marking a significant milestone in its mission to transform shared mobility across the country.

The Series E funding round was led by WestBridge Capital, a prominent investment firm focused on investments in India. The round also saw participation from existing investor Nexus, along with new investors Think Investments and Invus Opportunities. This latest investment elevates Rapido’s post-money valuation to $1.1 billion, reinforcing its strong position in the urban mobility sector.

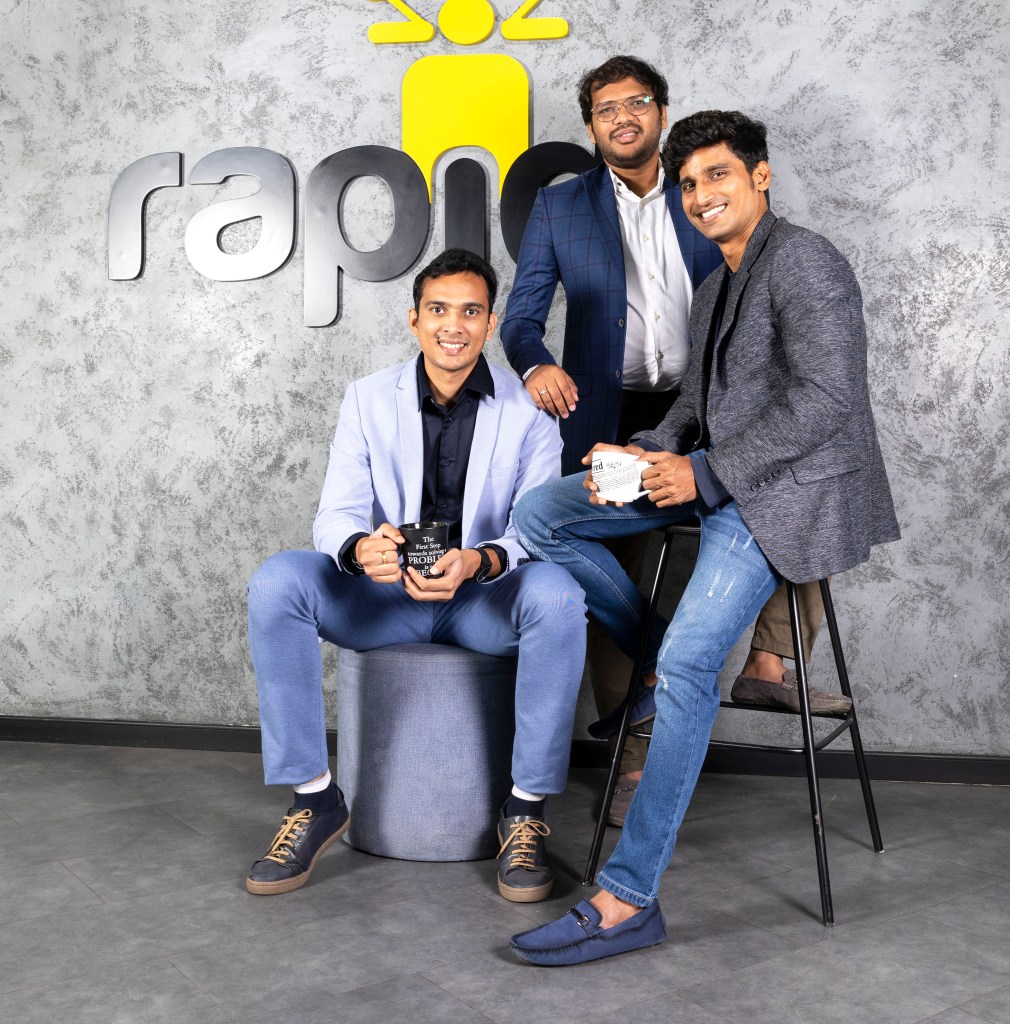

Speaking on the funding AravindSanka, Co-founder of Rapidosaid, “With this new infusion of capital, we are eager to explore and expand our offerings, ensuring we meet the evolving needs of our customers. Over the past year, we’ve experienced significant growth, with our daily rides surging to 2.5 million. This investment will empower us to continue innovating and improving our services, allowing us to better serve our customers and make significant strides in enhancing urban mobility for everyone.”

Sumir Chadha, co-founder and Managing Partner at WestBridge Capital, said “In the five years since the initial investment made in Rapido, we’ve seen Aravind, Pavan, Rishikesh and the team transform it into India’s leading low-cost mobility platform. From dominating bike taxis to making significant strides into 3W autos and cabs, their growth is a testament to their operational rigor and relentless focus on customer and captain satisfaction. We congratulate the team on their capital efficient scaleup, which now positions Rapido amongst India’s most used consumer internet apps. This latest funding round underscores our ongoing commitment to their journey“

The newly raised funds will be strategically allocated to expanding Rapido’s operations across India and scaling its technology platform to enhance service delivery. Rapido plans to grow its operations across all categories, including bike-taxis, three-wheelers, and taxi-cabs.

Since its inception 9 years ago, by driving more than 150% year-on-year growth, Rapido has revitalized the consumer internet space in India, solidifying its position as a leader in the shared mobility sector. Initially focused on bike-taxis, the company has since diversified into auto and cab services, expanding its value proposition and strengthening its operations. Rapido has also extended its reach beyond metro cities, establishing a presence in over 100 cities, including tier 2 and 3 cities across the country.

About Rapido

Rapido is India’s leading commute app, offering seamless auto, bike taxi, and cab services across 100+ cities. Founded in 2015, Rapido has revolutionized shared mobility, rapidly expanding its offerings from bike taxis to include auto-rickshaws and cabs. The company has played a pivotal role in creating employment opportunities for gig workers across the country. Committed to women empowerment, Rapido prioritizes secure livelihood opportunities for women in the shared mobility sector. By extending its services beyond metro and tier 1 cities, Rapido has strengthened connections in tier 2 and 3 cities, bringing reliable transportation to more people nationwide. Utilizing cutting-edge technology, the Rapido app provides users with quick, affordable access to bike taxis, autos, and cabs, ensuring convenience and cost-effectiveness.

About WestBridge Capital

WestBridge Capital is an experienced investment firm, managing over $7.5Bn of capital across investment funds in India and Mauritius. WestBridge Capital leverages both its capital and experience to help companies succeed. WestBridge seeks to partner with some of India’s most promising mid-sized companies for the long-term, whether they are public or private. Over the course of their careers, the team at WestBridge has led investments in over 150 companies. Armed with this wealth of experience, the team at WestBridge is able to assist its portfolio companies –when required– in many areas including strategy, operations, management recruiting and fundraising.